workers comp settlement taxes

Workers Compensation Benefits and Your Tax Return. Although workers comp benefits generally are not taxable any retirement benefits youve collected based on your age.

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Thus workers comp settlements are not taxable both at the state and federal level.

. In short no. It doesnt matter whether youre receiving monthly payments or a lump sum settlement. Wages and salary earned after returning to work with a partial disability and while still receiving benefits from workers comp or another program is fully taxable as income.

According to the 2018 Publication 525 from the IRS amounts received from workers compensation for work-related injury or illness are exempt from tax when paid under the. Workers compensation is a public federally funded benefit designed to help employees settle their bills as they recover from a work-related illness or injury. According to the Internal Revenue Service IRS workers comp settlements under federal law do not qualify as taxable income for state or federal levels.

The maximum amount owed for workers comp in Kansas is 627. The short answer is no. To ensure full coverage of workers injured on the job an employer may pay two-thirds of the employees weekly wages.

For example suppose you settle your claim for 50000 your lawyer has already paid 2000 in costs and. Other Tax Issues Involving Workers Compensation Retirement Benefits. Usually workers compensation benefits will not affect your tax return.

Do you pay taxes on a workers comp settlement. If you are currently on workers compensation benefits and do not see a W-2 for the tax year while you. Whether you receive a lump sum or bi-weekly workers compensation benefit payments it is not considered taxable.

Midtown Atlanta Office 1201 West. Workers compensation payments are generally tax-free. Under the Income Tax Assessment Act 1997 the payment of a lump sum amount in relation to a motor.

Ann Code 42-9-360 workers compensation income replacement benefits in South. Typically lawyers will deduct these costs before attorneys fees are calculated. You do not have to pay taxes on a workers compensation settlement in South Carolina.

Workers compensation is a tax. Most people do not need to pay taxes on their workers comp benefits or settlement. If a worker settles a workers comp case and also receives SSDISSI benefits and the settlement is an amount above 80 of their pre-injury income then their workers comp may get taxed.

Workers Compensation Settlements Rosenfeld Injury Lawyers

Will My Workers Compensation Be Taxed In North Carolina Cardinal Law

Are Personal Injury Settlements Taxable Hill Law Firm

Workers Compensation Settlement Calculator

Workers Compensation And Taxes Phalenlawfirm Com Ks And Molaw Office Of Will Phalen

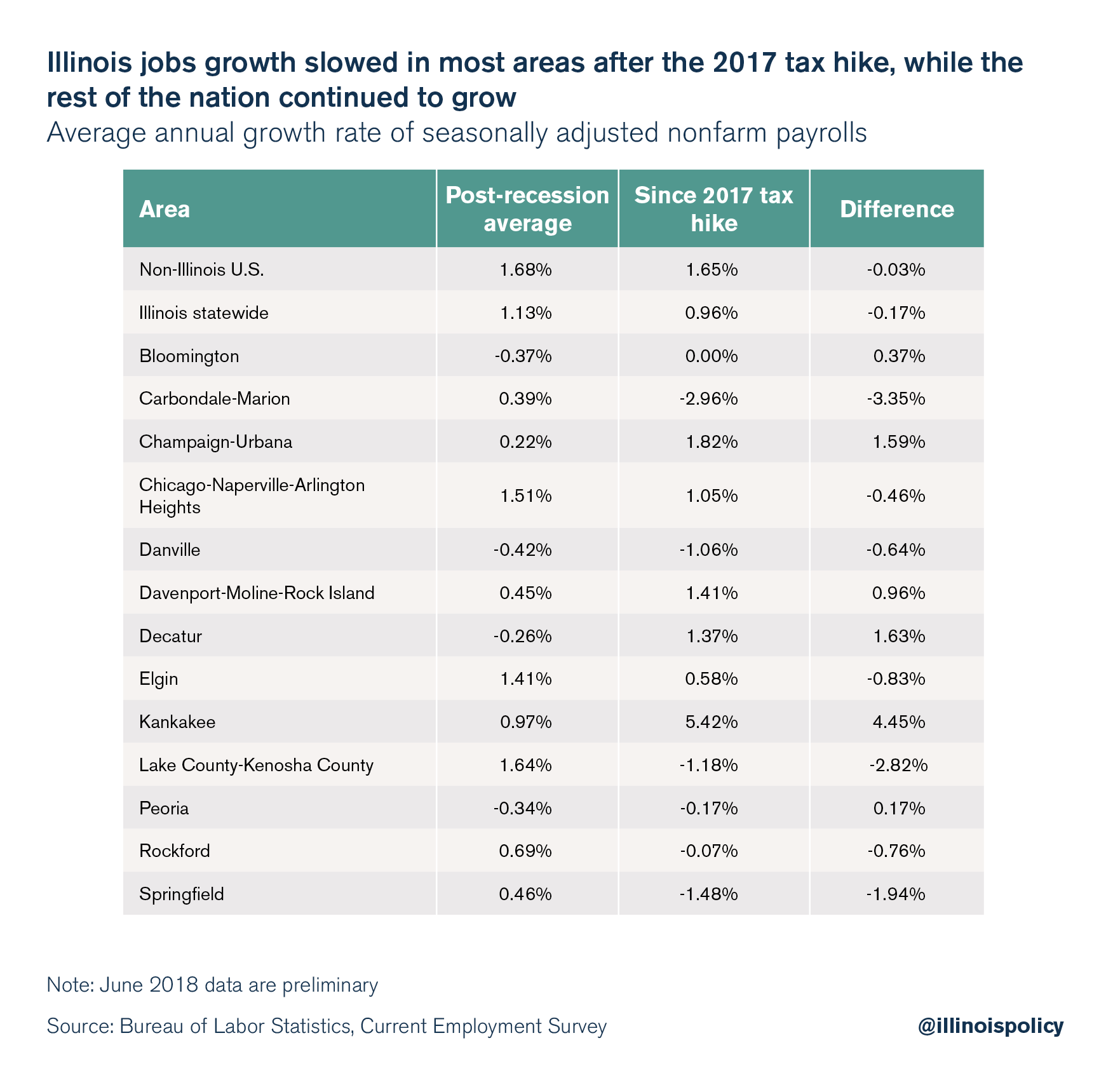

Will The New Tax Laws Affect My Workers Comp Or Personal Injury Settlement Airport Injury Law

Workers Comp Settlements In Pennsylvania Calhoon And Kaminsky P C

Lump Sum Workers Comp Settlements Schwartz Law

Is Workers Comp Taxable In Nj Craig Altman

Belleville Spent More Than 2 5m On Workers Comp Settlements In Less Than 5 Years

Are Worker S Compensation Claims Taxable In Massachusetts

Workers Comp Settlement Program Falls Short By 242 Million L I Announces Fuels Debate Over Reform Bill Washington State Wire

Do I Have To Pay Taxes On A Workers Compensation Settlement Workers Compensation Lawyers Ben Crump

Do I Have To Pay Taxes On Workers Compensation Benefits Or Settlements

Workers Compensation And Taxes

Is Workers Comp Taxable Income In Michigan What You Need To Know

Minnesota Work Comp Benefits Are Non Taxable Meuser Yackley Rowland